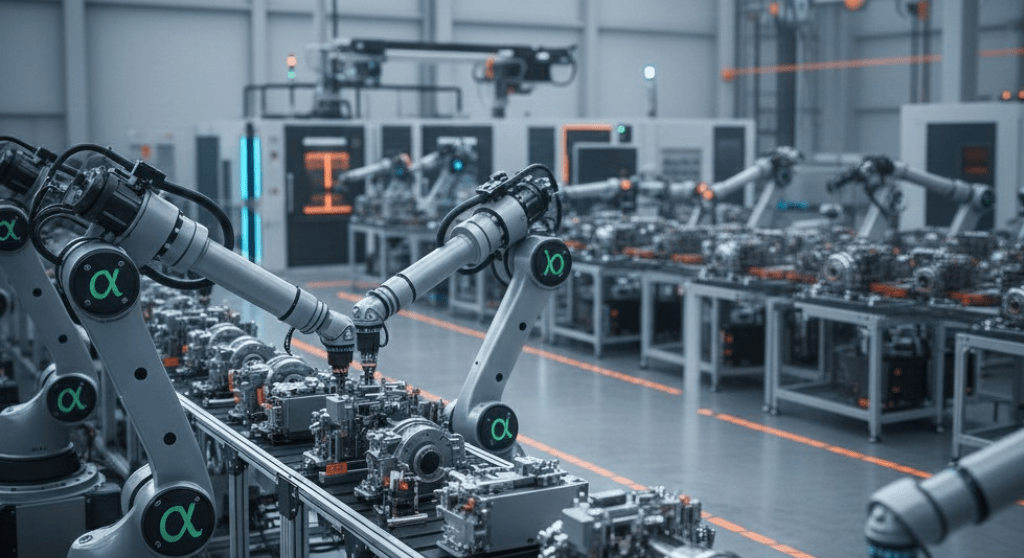

Our predictive engine highlights VOLV-B.ST (AB Volvo (publ) as the top Industrials pick with a +91.8% weighted return forecast across multiple time horizons, signaling standout momentum within the sector. The Industrials outlook looks constructive as cyclical demand and automation investments drive upside potential.

Industrials Sector Pulse

Our model is showing strong signals across multiple Industrials stocks, with broad-based momentum and rising conviction in key equipment and services names. Volume, trend persistence, and cross-horizon strength suggest a compelling risk/reward backdrop for selective longs.

Spotlight: VOLV-B.ST – Industrials Sector Leader

VOLV-B.ST (AB Volvo (publ) posts an exact weighted return of +91.8%, reflecting powerful multi-horizon gains. Our model points to a 2-week outlook of $512.62 (+76.3%), a 1-month outlook of $420.79 (+44.7%), and a 3-month outlook of $1078.90 (+271.0%), driven by persistent momentum, favorable demand signals, and improving operational dynamics. These cross-timeframe signals are why our predictive engine favors VOLV-B.ST within Industrials. Expect continued upside as the sector’s recovery and investment cycle play out.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.