Our predictive engine highlights RAND.AS (Randstad NV) as the top Industrials pick with a +61.7% weighted return forecast across multiple time horizons. The Industrials sector outlook is constructive, with momentum building in services and capital goods that our model interprets as durable.

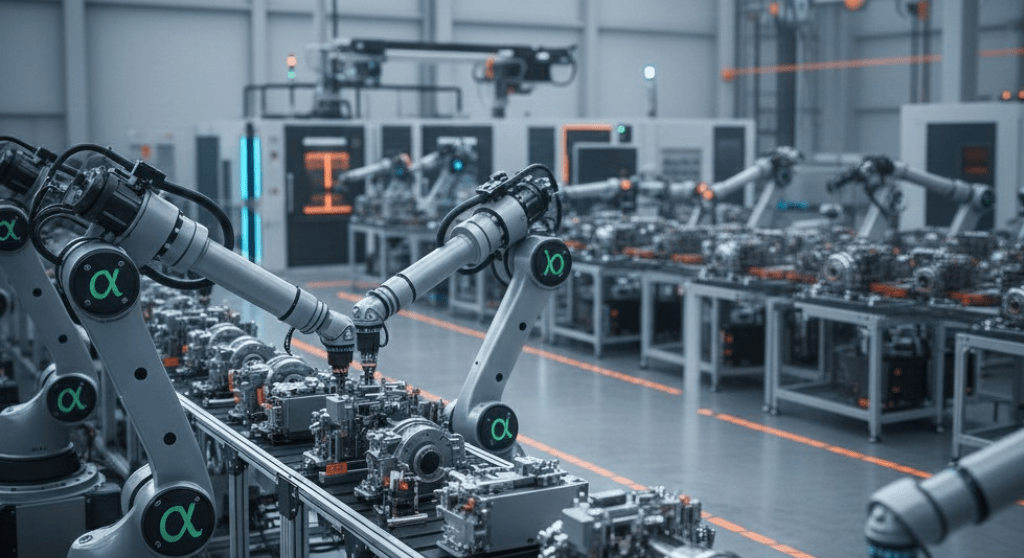

Industrials Sector Pulse

Sentiment across Industrials is broadly positive: our predictive engine is showing strong signals across multiple Industrials stocks, reflecting improving demand, supply-chain normalization and selective pricing power. Market breadth in the sector suggests opportunities for active positioning as macro indicators stabilize.

Spotlight: RAND.AS – Industrials Sector Leader

RAND.AS (Randstad NV) posts a +61.7% weighted return and stands out for multi-horizon strength. Our model points to a 2-week outlook of $54.01 (+69.0%), a 1-month outlook of $51.34 (+60.6%) and a 3-month outlook of $39.00 (+22.0%), driven by resilient staffing demand and strong momentum in placement metrics. The predictive engine favors Randstad for its consistent cash generation and leading exposure to tight labor markets. Expect the Industrials sector to offer selective upside as cyclical recovery takes hold.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.