Our predictive engine highlights EPI-A.ST (Epiroc AB (publ)) as the top Industrials pick with a +86.0% weighted return forecast across multiple time horizons. The Industrials sector looks poised for continued momentum, led by strong machine- and infrastructure-related signals.

Industrials Sector Pulse

Momentum indicators from our model show broad-based strength across multiple Industrials stocks, with conviction rising on durable demand and operational leverage. Sentiment is constructive in the near and medium term, and volatility appears to be presenting selective entry opportunities. Our model is showing strong signals across multiple Industrials stocks without leaning on short-term noise.

Spotlight: EPI-A.ST – Industrials Sector Leader

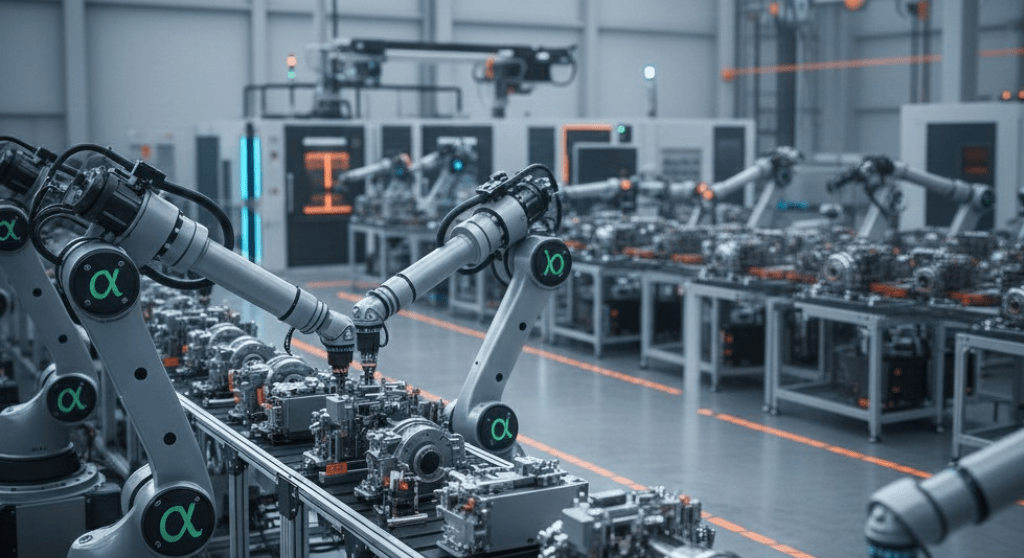

EPI-A.ST (Epiroc AB (publ)) carries a +86.0% weighted return in our ranking, driven by robust aftermarket and equipment cycles. The 2-week outlook shows +37.9% potential, the 1-month outlook points to +262.2% upside, and the 3-month outlook indicates +25.2% tailwinds. Our predictive engine favors Epiroc for its resilient order flows, margin leverage and exposure to mining automation trends. Expect Industrials to remain an active alpha-seeking arena as macro normalization and capex renewal unfold.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.