Our predictive engine highlights SKF-B.ST (AB SKF (publ)) as the top Industrials pick with a +91.6% weighted return forecast across multiple time horizons.

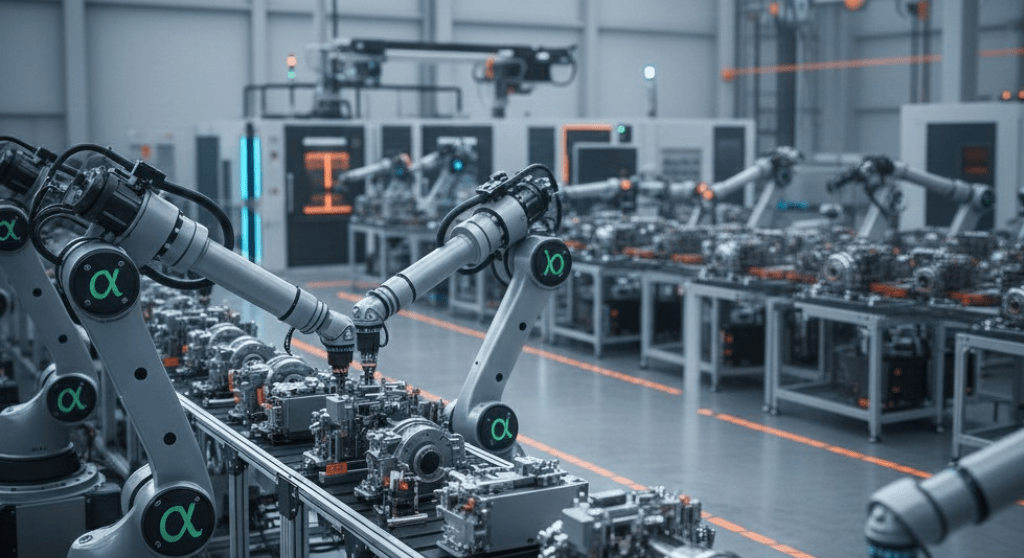

Industrials Sector Pulse

Momentum across Industrials is broadly positive: our model is showing strong signals across multiple Industrials stocks driven by accelerating capital expenditure and resilient aftermarket demand. Volatility remains elevated, but signal strength favors select equipment suppliers and exporters where order books are firm. Signs of inventory normalization and renewed capex are amplifying these signals, creating targeted entry points for both traders and longer-term investors.

Spotlight: SKF-B.ST (AB SKF (publ)) – Industrials Sector Leader

Our predictive engine assigns SKF-B.ST a +91.6% weighted return. The 2-week outlook points to $265.24 (+7.9%), the 1-month outlook to $270.13 (+9.9%), and the 3-month outlook to $2033.01 (+727.1%). The model favors SKF on pronounced momentum, improving margins signaled by proprietary datasets, a strengthening order book, and resilient aftermarket revenue visibility. If execution and macro tailwinds persist, SKF could anchor further upside across the Industrials sector.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.