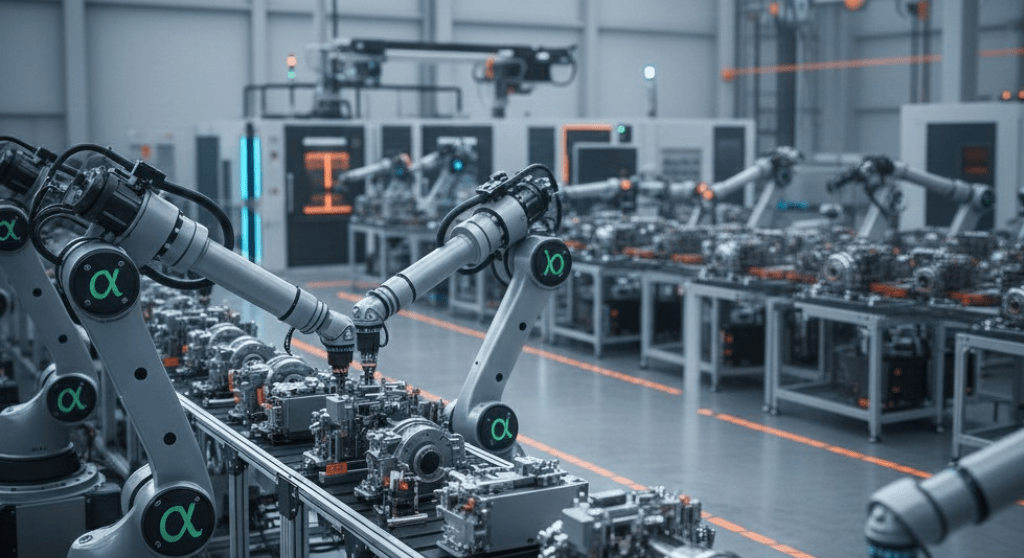

Our predictive engine highlights ALFA.ST (Alfa Laval AB) as the top Industrials pick with a +92.0% weighted return forecast across multiple time horizons, signaling a bullish outlook for select equipment and services names. The sector shows renewed momentum as cyclical demand and after-market resilience drive upside potential.

Industrials Sector Pulse

Sentiment across Industrials is constructive: our model is showing strong signals across multiple Industrials stocks, driven by accelerating momentum and improving earnings visibility. Investors should watch dispersion within the group as winners are emerging from both capital goods and industrial services.

Spotlight: ALFA.ST – Industrials Sector Leader

ALFA.ST (Alfa Laval AB) posts a +92.0% weighted return and stands out for its cross-horizon strength: 2-week outlook $804.29 (+74.3%), 1-month outlook $1298.10 (+181.3%), and 3-month outlook $566.90 (+22.9%). Our predictive engine favors it for consistent multi-horizon momentum, volatility-adjusted upside, and strong recent flows into precision-engineering exposures. Positioning suggests Alfa Laval could capture both near-term rerating and sustained demand for its service-driven revenues.

Looking ahead, the Industrials sector appears poised for selective gains as supply-chain normalization and capex cycles play out.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.