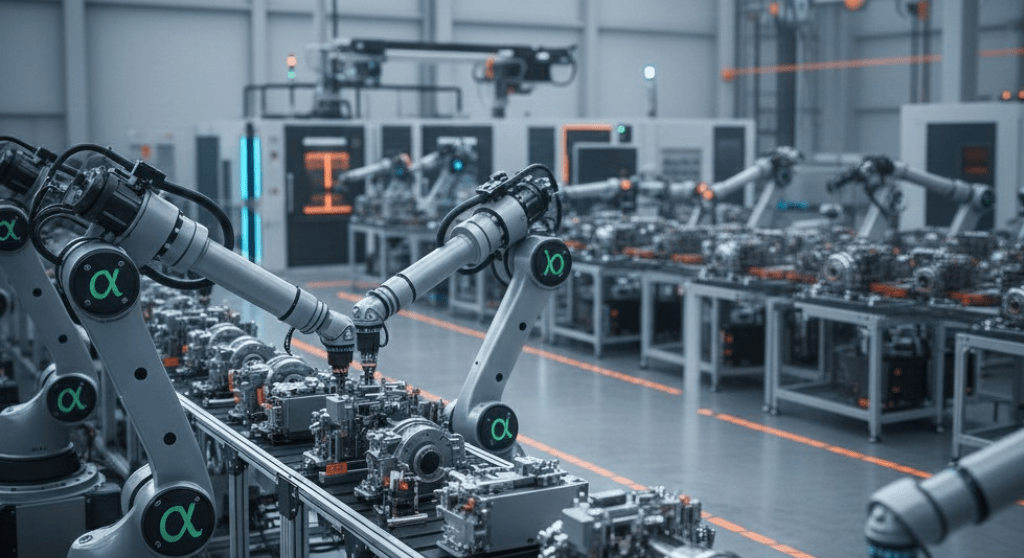

Our predictive engine highlights ATCO-A.ST (Atlas Copco AB Series A) as the top Industrials pick with a +68.4% weighted return forecast across multiple time horizons. The Industrials outlook looks constructive as durable goods demand and automation investments drive upside for select names.

Industrials Sector Pulse

Momentum signals are broad-based: our model is showing strong signals across multiple Industrials stocks, indicating coordinated recovery and selective strength in capital goods and services. Risk-adjusted return profiles favor companies with resilient order books and margin expansion potential.

Spotlight: ATCO-A.ST – Industrials Sector Leader

ATCO-A.ST (Atlas Copco AB Series A) posts a +68.4% weighted return in our ranking, supported by an attractive multi-horizon outlook: 2-week $183.24 (+11.7%), 1-month $608.44 (+270.9%), and 3-month $174.50 (+6.4%). Our predictive engine favors Atlas Copco for its exposure to industrial automation, a resilient service backlog, and operating leverage as demand normalizes. Expect the company to be a key beneficiary of capex cycles and efficiency upgrades. The Industrials sector looks poised for selective gains as economic reopening and investment in productivity technologies persist.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.