Our predictive engine highlights LR.PA (Legrand SA) as the top Industrials pick with a +21.0% weighted return forecast across multiple time horizons.

Industrials Sector Pulse

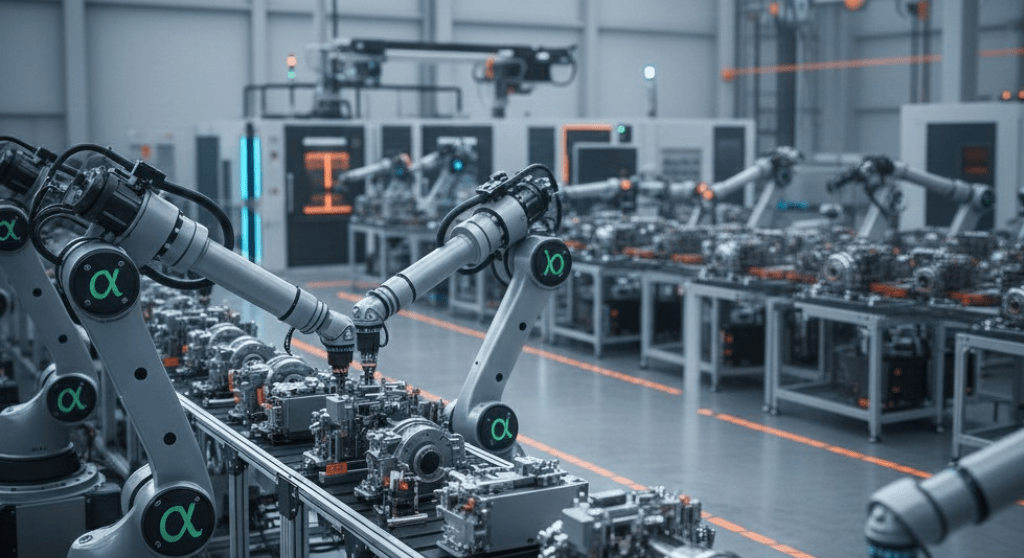

Momentum is broad-based: our model shows strong buy signals across multiple Industrials names, driven by resilient demand in building products and supply-chain services. Volatility appears to favor selective gains, with several stocks flashing multi-horizon upside. Tradeable momentum is emerging across building materials, logistics and industrial components.

Spotlight: LR.PA – Industrials Sector Leader

LR.PA (Legrand SA) posts a +21.0% weighted return in our ranking, underpinned by improving European construction activity and margin expansion prospects. Our horizon view shows 2-week potential to $135.39 (+7.6%), 1-month to $139.83 (+11.2%), and a striking 3-month scenario to $272.58 (+116.7%). Our predictive engine favors Legrand SA for its stable cash flow, product pricing power and exposure to retrofit cycles that benefit distributor networks. Looking ahead, the Industrials sector seems poised for renewed upside as capex and renovation trends accelerate.

What You’re Missing in Financial

There are 4 MORE Financial stocks flagged by our predictive engine with strong signals and complementary risk-return profiles. The full report includes sector target ranges and optimal holding windows.Unlock Full Financial Analysis

Subscribe to Premium to access:- All 5 top Financial picks with complete analysis

- 2-week, 1-month, and 3-month price targets

- Sector comparison charts

- Optimal entry and holding strategy for Financial Subscribe now to unlock the full sector playbook from our predictive engine.